Apply for Funeral Cover – Peace of Mind Starts Today

How to Apply for Funeral Cover Today

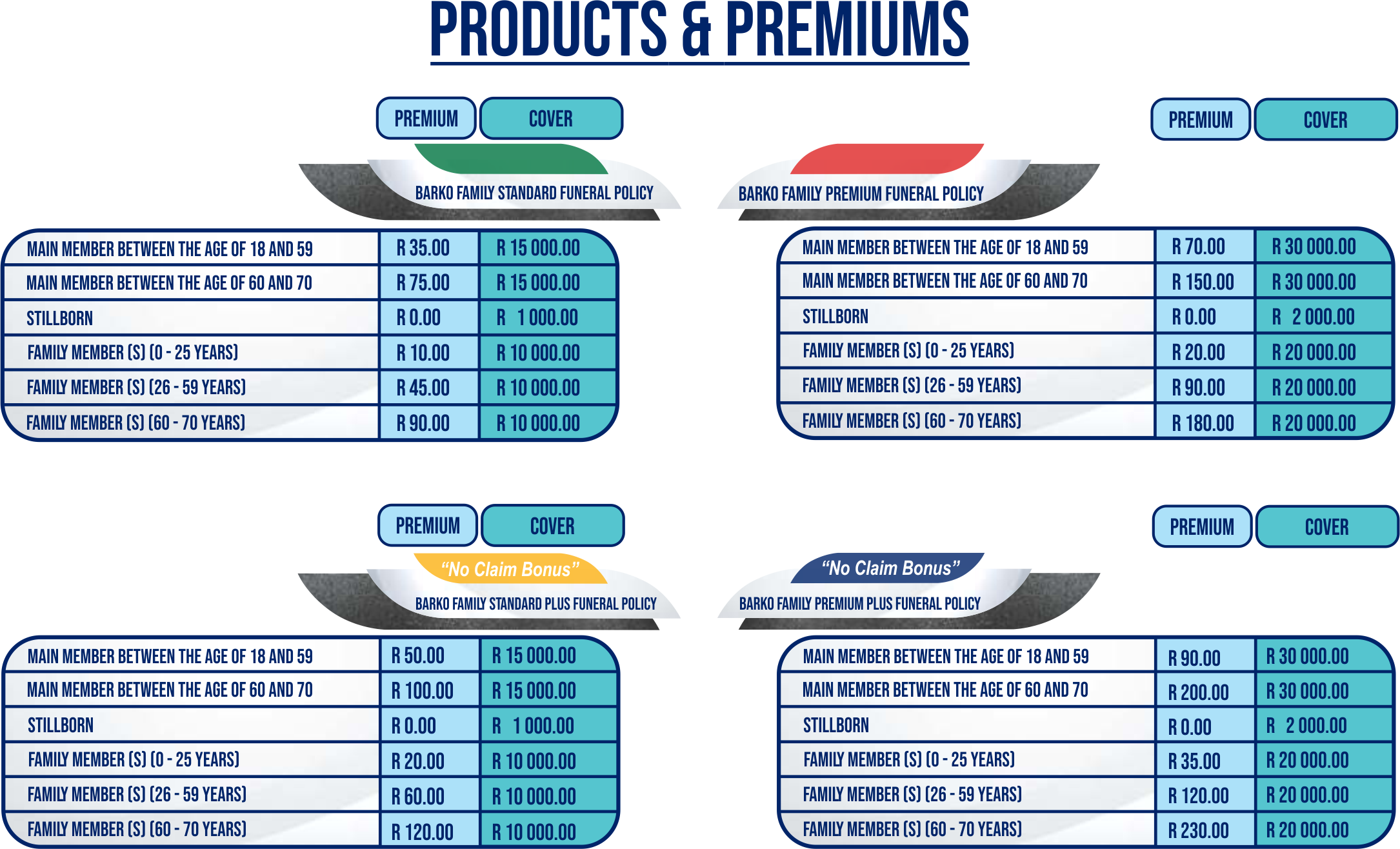

Barko makes it easy to protect your loved ones with reliable, affordable funeral cover.

What Our Funeral Cover Includes

FAQ

Product provider and underwriter ▼

The Product Provider is Barko Financial Services (Pty) Ltd (Barko), registration number 1999/022139/07, an authorised Financial Services Provider (FSP 45614).

The product is underwritten by Guardrisk Life Limited (Insurer), registration number 1999/013922/06, a Licensed Life Insurer and authorised Financial Services Provider (FSP 76).

Legal and contractual relationship with the insurer▼

The Insurer and Barko have concluded a shareholder and subscription agreement that entitles Barko to place insurance business with the Insurer. The shareholder and subscription agreement entitles Barko to share in the profits and losses generated by the insurance business. The Insurer may distribute dividends, at the sole discretion of the Insurer’s Board of Directors, to Barko during the existence of the Policy.

How to qualify and who is eligible ▼

To purchase the policy, you must be at least 18 (eighteen) years old.

You can add 1 (one) Main Member and up to 13 (thirteen) family members to the policy.

The Main Member can choose to be the Policyholder with cover, or another family member can be nominated as the Main Member. The Policyholder pays the premiums, but the Policyholder will not have cover if another family member is the Main Member.

Cover is available for natural people up to 70 (seventy) years of age.

Free cover is provided for stillborn children undergoing at least 26 (twenty-six) weeks of intra-uterine development, excluding intentional termination.

Important terms and conditions ▼

You have a 31 (thirty-one) day cooling-off period during which you can cancel the policy in writing. Barko will refund all received premiums if the cancellation occurs within this cooling-off period.

In case of a missed premium, you can bring it up to date by paying a double premium within the grace period. (Within 31 (thirty-one) days after the missed premium).

During the grace period, your cover remains active, and your policy will be reinstated upon receipt of the double premium within 31 (thirty-one) days after the missed premium. Regular premium payments will keep your policy active.

If you miss the first and second monthly premiums after purchasing the policy, the policy will become not taken up (terminated), and no further premiums are payable. You can purchase a new policy if you're still interested.

Missing 2 (two) consecutive monthly premiums (excluding the first 2 (two) premiums after purchase) will lead to an automatic lapse of the policy (termination). You can purchase a new policy if you're still interested.

The Standard “Plus” and Premium “Plus” products include a no-claim cash-back benefit. Barko will reimburse 1 (one) year's premium (20 % of your premiums paid) after 5 (five) years, provided no claims were paid and all premiums were paid consecutively for 5 (five) years. Any unpaid/disputed premiums will reset the no-claim cash-back period, and the benefit is payable within 5 (five) years after the subsequently paid premium, subject to consecutive premiums paid and no claims paid.

You have the flexibility to upgrade/downgrade between the products.

You need to nominate at least 1 (one) beneficiary older than 18 (eighteen) years for your policy. The beneficiary won't have cover unless nominated as a Main Member or Family Member in your policy.

You can cancel your policy at any time by providing Barko with at least 31 (thirty-one) days prior written notice. You'll remain liable for the premium during the cancellation notice period while still having cover.

The premium will not change for the first 12 (twelve) months unless there are reasonable actuarial grounds to do so. Any change will be notified to the Policyholder with 31 (thirty-one) days’ notice.

Funeral policy documents ▼

How to submit a claim▼

All Claim documentation must be submitted to Barko within 6 (six) months of the date of the Claim Event.

Main Member

Upon the death of the Main Member, the Policyholder/Beneficiary/Claimant must visit any Barko Branch and submit the following documentation:

• The funeral claim form must be completed and signed.

• Copy of the Policyholder’s ID.

• Copy of the Main Member’s ID if the Main Member is not the same person as the Policyholder.

• Copy of the ID of the Beneficiary/Claimant if the Main Member is not the same person as the Policyholder.

• Death Certificate.

• Copy of the DHA 1663 – Notice of Death Form.

• A police report completed by the investigation officer where the death is as a result of a motor vehicle accident, suicide, murder, or where the death is under investigation.

• Copy of the latest Bank Statement of the Policyholder/Beneficiary/Claimant.

• Proof of Residence of the Policyholder/Beneficiary/Claimant not older than 3 (three) months.

• We reserve the right to request additional information to verify or process the Claim, which must be provided at the Policyholder and/or Beneficiary’s costs.

Family Member(s)

Upon the death of any of the Family Member (s), the Policyholder must visit any Barko Branch and submit the following documentation:

• The funeral claim form must be completed and signed.

• Copy of the Policyholder’s ID.

• Copy of the latest Bank Statement from the Policyholder.

• Copy of the deceased Family Member (s) ID or, in the event of the deceased being under the age of 16 (sixteen) years, a copy of the deceased Family Member (s) birth certificate.

• Death Certificate.

• Copy of the DHA 1663 – Notice of Death Form.

• A police report completed by the investigation officer where the death is as a result of a motor vehicle accident, suicide, murder, or where the death is under investigation.

• Proof of Residence of the Policyholder not older than 3 (three) months.

• We reserve the right to request additional information to verify or process the Claim, which must be provided at the Policyholder's cost.

Stillborn

Upon the death of any Stillborn, the Policyholder must visit the nearest Barko Branch and submit the following documentation:

• The funeral claim form must be completed and signed.

• Copy of the Policyholder’s ID.

• Copy of the latest Bank Statement from the Policyholder.

• Death Certificate.

• Registered medical practitioners report confirming that the fetus was at least in existence for 26 (twenty-six) weeks of intrauterine existence and that the child was “Stillborn”.

• Proof of Residence of the Policyholder not older than 3 (three) months.

• We reserve the right to request additional information to verify or process the Claim, which must be provided at the Policyholder's cost.

Claims can be submitted at any Barko Branch or via email at funeral@barko.co.za.

Claims waiting periods ▼

Accidental death is covered without a waiting period.

A 6 (six) month waiting period applies for natural death in new policies.

A 12 (twelve) month waiting period is in effect for death by suicide.

Claims (upgrade)

Accidental death is covered without a waiting period.

An additional 6 (six) month waiting period applies for natural death from the upgrade date.

An additional 12 (twelve) month waiting period is in effect for death by suicide from the upgrade date.

If a claim is received within the above-mentioned waiting periods, the cover will be in terms of the initial policy purchased prior to the upgrade.

Claims (downgrade)

No additional waiting periods will apply, and subject to the initial policy waiting periods, all claims will be paid in terms of the downgrade policy.

No-claim cash back benefit▼

If you upgrade/downgrade between the Standard “Plus” and Premium “Plus” products within the 5 (five) year’s period, your No-Claim Cash Back Benefit will be paid pro rata (20 % of your premiums paid).

If you upgrade/downgrade from a Standard and Premium product to a “Plus” product, the 5 (five) years will only start running from the date of the upgrade/downgrade. However, if you upgrade/downgrade from a “Plus” product to a Standard and Premium product, you will forfeit the No-Claim Cash Back Benefit.

Complaints ▼

For complaints, you can contact us as follows:

• Send an email to customercare@barko.co.za

• Send an email to funeral@barko.co.za

• Phone us on our Toll-free number 080-777-3777

Contact us▼

If you require assistance or advice, please feel free to reach out to Barko through the following channels:

• Send an email to customercare@barko.co.za

• Send an email to funeral@barko.co.za

• Phone us on our Toll-free number 080-777-3777

• Phone us on 064-870-5327

Where can I find the nearest branch? ▼

Visit the Barko Loans website and use the Branch Locator tool.

.png)